As required by the Wage Theft Ordinance (SMC 14.20), employers must pay all compensation owed on a regular pay day and give employees written information about their job and pay. Written notice of employment must be given to employees at time of hire and with changes to terms.

Written Information must include:

Written Information must include:

- Name of employer and any trade (“doing business as”) names used by the employer

- Physical address of the employer’s main office or principal place of business and, if different, a mailing address

- Telephone number and, if applicable, email address of employer

- Employee’s rate or rates of pay, and, if applicable, eligibility to earn overtime rate or rates of pay

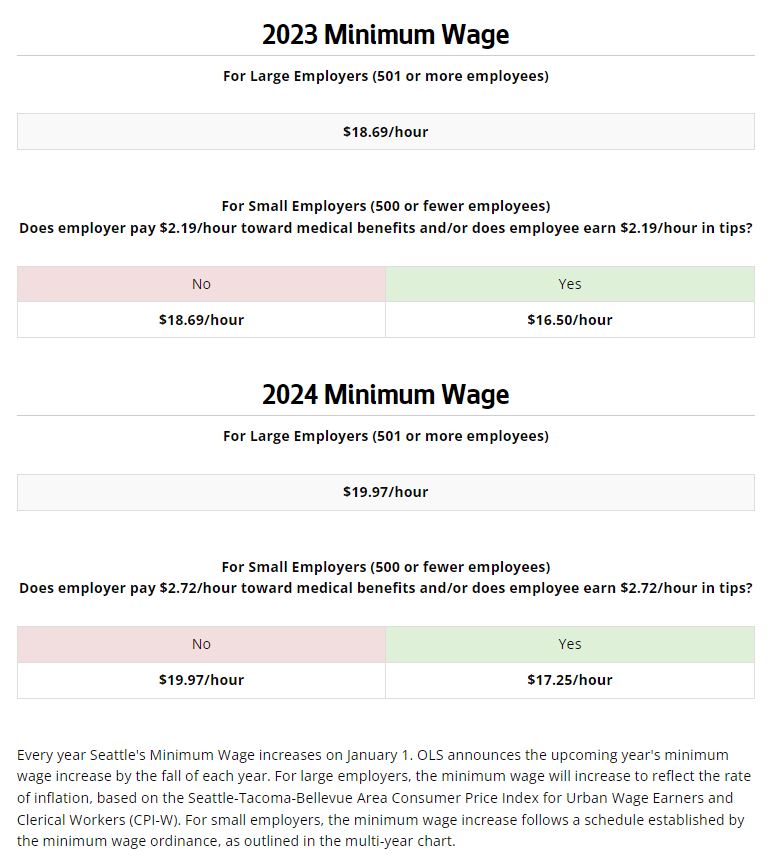

- Rate of pay must meet current Seattle Minimum Wage based on employer size. Current Minimum Wage Ordinance (SMC 14.19) requirements can be found below:

Secure Scheduling Ordinance (SMC 14.22)

If your business falls in the category of retail and food services establishments with 500+ employees worldwide or full service restaurants with 40+ full-service locations worldwide, you need to follow the Secure Scheduling Ordinance. For more information on the Secure Scheduling Ordinance and/or to determine if your business falls under those guidelines, click on the button below:

If your business falls in the category of retail and food services establishments with 500+ employees worldwide or full service restaurants with 40+ full-service locations worldwide, you need to follow the Secure Scheduling Ordinance. For more information on the Secure Scheduling Ordinance and/or to determine if your business falls under those guidelines, click on the button below:

Commuter Benefits Ordinance (SMC 14.30)

Effective and enforced starting on January 1st, 2020 - Businesses with 20 or more employees will be required to offer their employees the opportunity to make a monthly pre-tax payroll deduction for transit or vanpool expenses. Because the deduction is pre-tax, the law has the added benefit of lowering the tax bills for both workers and businesses.

For more information about the Commuter Benefits Ordinance and to access other useful resources pertaining to this Ordinance, please click on the button below:

Effective and enforced starting on January 1st, 2020 - Businesses with 20 or more employees will be required to offer their employees the opportunity to make a monthly pre-tax payroll deduction for transit or vanpool expenses. Because the deduction is pre-tax, the law has the added benefit of lowering the tax bills for both workers and businesses.

For more information about the Commuter Benefits Ordinance and to access other useful resources pertaining to this Ordinance, please click on the button below:

Do you have this form/are currently using one?